Enter DeBank – a beacon of dedication, committed to arming users with the indispensable tools and knowledge necessary for mastering the complexities of DeFi. Embark on a journey into the heart of DeBank’s significance within the DeFi ecosystem. Here, we uncover its pivotal role in facilitating data-driven decision-making for both seasoned investors and enthusiastic newcomers.

From offering comprehensive portfolio tracking to meticulous transaction monitoring, from unveiling insightful yield farming analytics to conducting rigorous risk assessments, DeBank stands tall as a stalwart empowering users to navigate the dynamic seas of decentralized finance with unwavering confidence and crystal-clear clarity.

Understanding DeFi: A Primer

DeFi, an abbreviation for decentralized finance, represents a rapidly expanding ecosystem of financial tools and services leveraging blockchain technology. Unlike the conventional financial system, which heavily depends on intermediaries like banks, DeFi operates in a decentralized fashion, utilizing smart contracts and decentralized protocols to facilitate direct peer-to-peer transactions and financial activities.

Welcome to your crash course in DeFi essentials, designed to demystify the intricate web of concepts and components defining the decentralized finance space:

- Blockchain: At the heart of DeFi lies blockchain technology, a distributed ledger system recording transactions across a network of computers. Ensuring transparency, security, and immutability, blockchain forms the backbone of the decentralized finance revolution;

- Smart Contracts: Enter smart contracts, the self-executing code embodying the terms of agreements within DeFi protocols. These contracts autonomously enforce terms when predefined conditions are met, eliminating the need for intermediaries and streamlining transactions;

- Decentralized Exchanges (DEX): Meet DEXs, platforms facilitating direct peer-to-peer trading of cryptocurrencies and digital assets. Operating via smart contracts, DEXs enable secure, transparent transactions sans intermediaries, revolutionizing the traditional exchange model;

- Lending and Borrowing: Explore DeFi platforms enabling users to lend assets for interest or borrow with collateral. Utilizing smart contracts, these protocols automate lending markets, fostering efficient and decentralized financial ecosystems;

- Yield Farming: Venture into the realm of yield farming, where users provide liquidity to DeFi protocols in exchange for rewards, often in the form of tokens or interest. Through staking assets in liquidity pools or participating in mining programs, users unlock lucrative yield opportunities;

- Stablecoins: Witness the rise of stablecoins, cryptocurrencies pegged to stable assets like fiat currencies. Serving as a stable medium of exchange and store of value within DeFi, stablecoins play a pivotal role in fostering stability amidst volatile markets;

- Tokenization: Embrace tokenization, the process of representing real-world assets as digital tokens on the blockchain. Facilitating fractional ownership and increased liquidity, tokenization opens doors to innovative asset management and investment strategies within DeFi;

- Governance Tokens: Engage with governance tokens issued by DeFi protocols, granting holders voting rights and decision-making power. By participating in governance processes, users shape the trajectory of DeFi platforms and steer the course of innovation;

- Security and Risks: Navigate the DeFi landscape mindful of potential risks, including smart contract vulnerabilities, impermanent loss, and regulatory uncertainties. Conduct thorough research and exercise caution to mitigate risks and safeguard your investments.

In summary, DeFi heralds a groundbreaking evolution of finance, offering unparalleled accessibility, transparency, and innovation. As the ecosystem matures, its impact on the future of finance is bound to grow exponentially, reshaping financial paradigms for generations to come.

The Importance of DeFi Tools

DeFi tools are the harbingers of a financial revolution, breaking down barriers and empowering individuals with unprecedented control and accessibility over their assets. Unlike the traditional financial system, which often operates behind closed doors, DeFi protocols operate on the principles of transparency and autonomy. They don’t hold custody over users’ funds, allowing individuals to maintain full control over their assets at all times.

Through the power of blockchain technology, DeFi tools enable peer-to-peer transactions and interactions without the need for intermediaries. This decentralization not only promotes trust and transparency but also opens up new doors of opportunity for individuals worldwide. Regardless of geographical location or socioeconomic status, anyone with an internet connection can participate in decentralized ecosystems, from lending and borrowing to trading and yield farming.

In essence, DeFi tools are leveling the playing field, democratizing finance, and giving rise to a more inclusive financial landscape. They represent a paradigm shift away from the exclusivity of traditional finance, offering a seat at the table to anyone with the vision and ambition to seize it. As we continue to witness the evolution of decentralized finance, one thing remains clear: the future of finance belongs to the people:

- Accessibility: DeFi tools make it easier for users to access and participate in decentralized finance. These tools typically include user-friendly interfaces, mobile applications, and web platforms that allow individuals to interact with DeFi protocols without requiring technical expertise or understanding of blockchain technology;

- Liquidity Provision: DeFi tools enable users to contribute liquidity to decentralized exchanges (DEXs) and liquidity pools, which are essential for maintaining trading volumes and price stability. Liquidity providers earn fees by supplying assets to these pools, incentivizing liquidity provision and market making;

- Risk Management: DeFi tools provide users with risk management solutions such as decentralized insurance, options trading platforms, and yield optimization strategies. These tools help users hedge against risks associated with smart contract vulnerabilities, market volatility, and protocol failures;

- Asset Management: DeFi tools offer users various asset management solutions, including decentralized asset management platforms, yield farming aggregators, and automated portfolio rebalancing strategies. These tools help users optimize their investment portfolios, maximize returns, and minimize risks across different DeFi protocols;

- Decentralized Identity and KYC Solutions: DeFi tools enable users to verify their identity and comply with regulatory requirements using decentralized identity and know-your-customer (KYC) solutions. These tools help users access DeFi services while maintaining privacy and control over their personal information;

- Cross-Chain Compatibility: DeFi tools facilitate interoperability between different blockchain networks by supporting cross-chain asset transfers, bridge protocols, and interoperability solutions. These tools allow users to seamlessly transfer assets between different DeFi protocols and take advantage of opportunities across multiple blockchain networks;

- Governance Participation: DeFi tools empower users to participate in the governance of decentralized protocols by voting on governance proposals, proposing protocol upgrades, and shaping the future direction of DeFi platforms. Governance participation gives users a voice in decision-making processes and ensures decentralized control over protocol parameters.

In the vibrant world of decentralized finance (DeFi), education is the cornerstone of empowerment. DeFi tools not only offer cutting-edge financial services but also serve as invaluable educational platforms, providing users with the knowledge and resources needed to navigate the complexities of blockchain technology.

From comprehensive tutorials to interactive learning modules, DeFi tools strive to demystify the intricacies of decentralized finance, empowering users to make informed decisions about their financial future. Whether you’re a seasoned investor or a curious newcomer, these educational resources offer a wealth of insights into the principles of blockchain technology, smart contracts, and the various protocols that comprise the DeFi ecosystem.

By providing educational resources and onboarding support, DeFi tools play a vital role in driving user adoption and expanding the reach of the DeFi ecosystem. They empower individuals from all walks of life to explore the boundless opportunities offered by decentralized finance, ultimately contributing to the growth and democratization of the global financial landscape.

Comparing DeFi Tracking and Trading Platforms

In the vast landscape of DeFi tools, three shining stars emerge: Zapper, Zerion, and DeBank. These platforms are not just tools; they are gateways to a decentralized financial utopia, each adorned with distinctive features crafted to cater to the diverse needs and desires of investors like yourself. Buckle up as we embark on a thrilling journey to unravel the wonders of these platforms

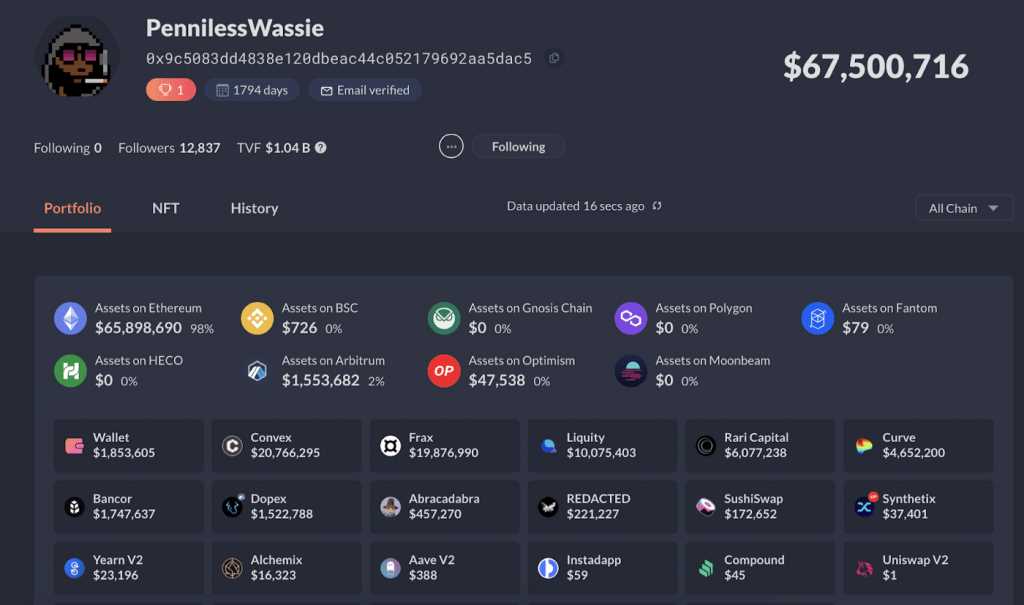

Zapper: Streamlining Liquidity-Focused Investments

Introducing Zapper, your ultimate DeFi companion designed to revolutionize liquidity-centric investments in the decentralized finance realm. With a plethora of features meticulously crafted to empower users, Zapper emerges as a beacon of efficiency and convenience in the ever-evolving DeFi landscape. Here’s a glimpse into the marvels of Zapper and why it stands as a game-changer:

Aggregated Dashboard: Say goodbye to the hassle of juggling between multiple interfaces and wallets. Zapper presents an integrated dashboard where users can effortlessly oversee their DeFi holdings across various protocols. From tracking portfolio performance to scrutinizing asset allocations, Zapper consolidates crucial information into a single, intuitive view.

- Liquidity Management: Seamlessly navigate the labyrinth of liquidity provision with Zapper’s arsenal of tools. Deposit, withdraw, and swap assets across diverse liquidity pools and decentralized exchanges with unparalleled ease. Harness the power to fine-tune liquidity strategies on the fly, optimizing yield in response to dynamic market conditions;

- Yield Farming Aggregator: Unlock the gates to lucrative yield farming opportunities scattered across DeFi protocols. Zapper acts as your trusty guide, curating the most rewarding farming strategies from disparate corners of the ecosystem. Embrace the path of least resistance as Zapper streamlines the journey to maximizing returns with minimal effort;

- Portfolio Rebalancing: Stay ahead of the curve with Zapper’s portfolio rebalancing capabilities. Let automation take the reins as asset allocations adapt to predefined parameters and investment strategies. Safeguard your portfolio against volatility, capitalize on emerging opportunities, and maintain a diversified stance in the DeFi arena;

- Gas Optimization: Bid farewell to exorbitant gas fees haunting DeFi transactions. Zapper pioneers gas optimization by bundling multiple transactions into cohesive batches, slashing costs and bolstering transaction efficiency. A boon for avid DeFi enthusiasts, this feature ensures seamless interaction with protocols without breaking the bank;

- Integration with Wallets and Protocols: Zapper seamlessly integrates with leading cryptocurrency wallets and DeFi protocols, eradicating barriers between users and the DeFi ecosystem. From MetaMask to Compound, access DeFi services directly from the Zapper platform with unparalleled ease and convenience;

- Embark on your DeFi journey with Zapper’s vibrant community and robust support infrastructure. Dive into extensive documentation, leverage insightful tutorials, and engage with fellow enthusiasts in interactive user forums. With personalized support at your beck and call, rest assured that Zapper has your back every step of the way.

In essence, Zapper transcends mere functionality to embody a paradigm shift in the realm of DeFi management. Embrace the future of decentralized finance with Zapper by your side, where efficiency meets empowerment in perfect harmony.

Zerion: Facilitating Diverse DeFi Transactions

Zerion is a DeFi (Decentralized Finance) platform that facilitates diverse DeFi transactions by providing users with a unified interface to interact with various DeFi protocols and services. Here’s how Zerion works and why it’s significant:

- Unified Dashboard: Zerion offers users a unified dashboard that displays their DeFi holdings and transactions across multiple protocols in a single view. This allows users to track their portfolio performance, monitor asset allocations, and analyze transaction history without the need to switch between different interfaces or wallets;

- Portfolio Management: Zerion enables users to manage their DeFi portfolios more effectively by providing tools to easily deposit, withdraw, and swap assets across different protocols and liquidity pools. Users can rebalance their portfolios, optimize asset allocations, and execute complex transactions with ease;

- Trading and Swapping: Zerion supports decentralized trading and swapping of assets through integration with decentralized exchanges (DEXs) and liquidity pools. Users can execute trades directly from the Zerion interface, allowing for seamless and efficient trading experiences without the need for multiple platforms or manual transaction execution;

- Yield Farming and Staking: Zerion aggregates yield farming opportunities and staking options from various DeFi protocols, allowing users to discover and participate in high-yield farming strategies with ease. Users can stake their assets, earn rewards, and optimize their yield farming strategies using the Zerion platform;

- Liquidity Provision: Zerion facilitates liquidity provision by offering tools to deposit assets into liquidity pools and provide liquidity for decentralized exchanges. Users can earn fees by supplying liquidity to these pools, contributing to the liquidity and efficiency of DeFi markets;

- Portfolio Analytics: Zerion provides users with advanced portfolio analytics and reporting tools to analyze their DeFi portfolios’ performance, track historical data, and identify trends. Users can gain insights into their investment strategies, assess risk exposure, and make informed decisions based on real-time data;

- Integration with Wallets and Protocols: Zerion seamlessly integrates with popular cryptocurrency wallets and DeFi protocols, allowing users to connect their wallets and access DeFi services directly from the Zerion platform. This integration simplifies the user experience and provides a seamless interface for interacting with DeFi protocols;

- Community and Support: Zerion fosters a vibrant community and offers comprehensive support resources, including documentation, tutorials, and user forums. The platform also provides personalized support to assist users with any questions or issues they may encounter while using the platform.

Within the dynamic realm of decentralized finance, Zerion emerges as a pivotal force, offering a unified interface that revolutionizes how users navigate diverse DeFi transactions. With Zerion at their fingertips, individuals can effortlessly oversee their DeFi portfolios, execute trades with precision, explore the realms of yield farming, and seamlessly interact with a myriad of DeFi protocols and services.

Zerion’s significance transcends mere convenience; it embodies a beacon of accessibility in the ever-expanding DeFi landscape. By distilling the complexities of decentralized finance into an intuitive platform, Zerion empowers users of all backgrounds to partake in the burgeoning DeFi revolution.

DeBank: Empowering Data-Driven DeFi Decisions

DeBank is a platform designed to empower users with data-driven insights for making informed decisions in the decentralized finance (DeFi) space. Here’s how DeBank facilitates data-driven DeFi decisions:

- Portfolio Tracking: DeBank allows users to track their DeFi portfolio across multiple wallets and protocols in real-time. Users can monitor their asset allocations, transaction history, and overall portfolio performance on a single dashboard. This comprehensive view enables users to assess the health of their DeFi investments and make adjustments as needed;

- Transaction Monitoring: DeBank provides users with detailed transaction information, including gas fees, transaction status, and transaction history. Users can track the status of their transactions and monitor their gas costs to optimize transaction efficiency and minimize costs;

- Yield Farming Analytics: DeBank offers analytics tools for yield farming, allowing users to evaluate the performance of different farming strategies and protocols. Users can compare farming yields, APRs, and other metrics to identify the most profitable opportunities and optimize their farming strategies accordingly;

- Liquidity Pool Analysis: DeBank provides insights into liquidity pool performance, including pool size, trading volume, and liquidity provider rewards. Users can analyze liquidity pool data to assess the potential risks and rewards of providing liquidity to different pools and make informed decisions about their liquidity provision strategies;

- Protocol Comparison: DeBank enables users to compare different DeFi protocols based on various metrics such as total value locked (TVL), trading volume, and user activity. Users can evaluate the strengths and weaknesses of different protocols and identify opportunities for diversification or optimization within their DeFi portfolio;

- Risk Assessment: DeBank offers risk assessment tools to help users evaluate the risk profile of different DeFi protocols and investments. Users can assess factors such as smart contract audits, security practices, and historical performance to gauge the level of risk associated with different assets and protocols;

- Community Insights: DeBank provides access to community insights and sentiment analysis, allowing users to stay informed about the latest developments, trends, and discussions in the DeFi community. Users can leverage community insights to inform their investment decisions and stay ahead of market trends.

DeBank offers educational resources and tutorials to help users understand key concepts and strategies in the DeFi space. Users can access guides, articles, and videos to deepen their knowledge and make more informed decisions about their DeFi investments.

Conclusion

In the dynamic arena of decentralized finance, the choice of tools wields immense influence over investment triumphs. Whether your focus lies in liquidity provision, portfolio diversification, or data-centric decision-making, platforms such as Zapper, Zerion, and DeBank stand ready to cater to your unique requirements. By harnessing the tailored solutions offered by these DeFi stalwarts, investors can confidently navigate the intricacies of decentralized ecosystems, empowering themselves to seize untapped opportunities and fine-tune their financial strategies amidst the ever-evolving DeFi landscape.

+ There are no comments

Add yours