In the digital age, managing personal finances has become increasingly complex. As new opportunities for wealth creation arise, individuals seek comprehensive and user-friendly financial management tools to streamline their asset tracking and investment strategies. In this article, we will delve into a detailed comparison of three leading financial management platforms—SigFig, Personal Capital, and Kubera. Each of these tools offers unique features and benefits tailored to different investor profiles. By examining their strengths and weaknesses, you can make an informed decision about which platform best aligns with your financial goals and preferences.

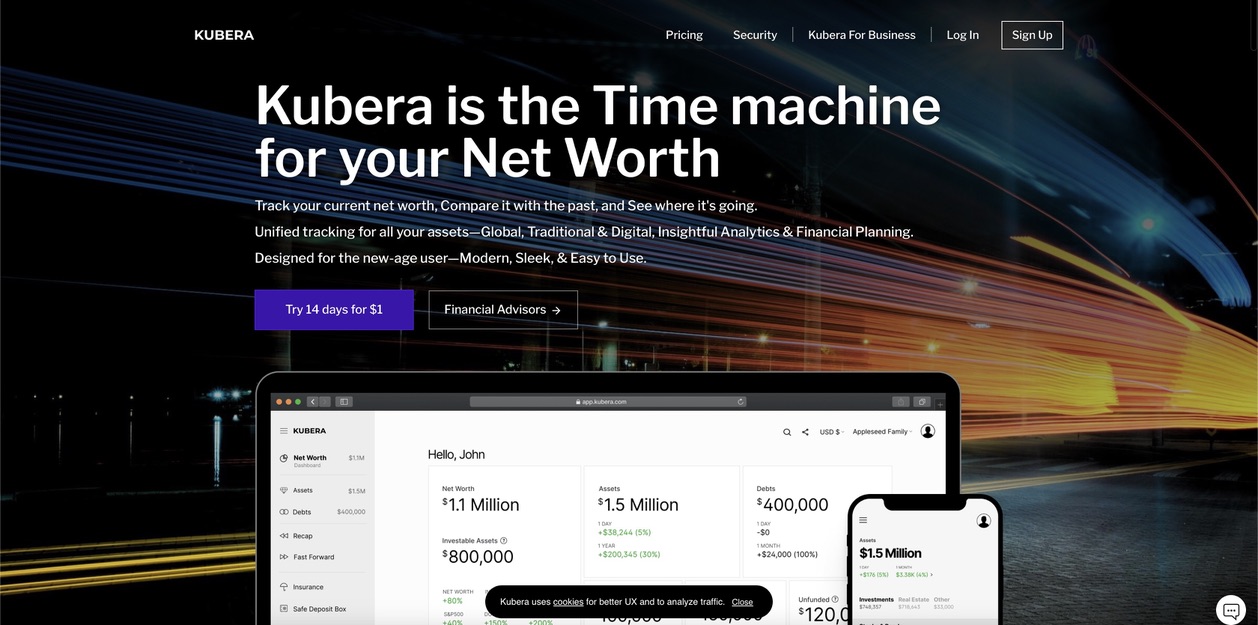

Kubera: A Well-Rounded Portfolio Management Tool for Modern, Diverse Investors

Kubera stands out as an all-in-one wealth tracker that transcends traditional wealth management by providing users with complete access to and control over their assets and supporting documentation in one centralized location. This platform caters to modern, diverse investors seeking a comprehensive solution for managing their financial portfolios.

About Kubera

Kubera’s primary objective is to empower users with a holistic approach to wealth management. The platform allows individuals to consolidate all their assets, including traditional investments, real estate holdings, and cryptocurrency, into a single, secure interface. Furthermore, Kubera offers robust features such as financial planning advice, portfolio health monitoring, document storage, and support for both fiat and cryptocurrencies. Its multifaceted capabilities enable users to tailor their wealth management strategy according to their unique preferences and financial objectives.

Try Kubera Today

To experience the full spectrum of benefits offered by Kubera, interested users can sign up for a trial account or explore the platform’s features through a guided demonstration. Kubera’s user-friendly interface and comprehensive functionalities make it an attractive option for individuals seeking a modern and versatile wealth management tool.

Benefits of Kubera:

- Comprehensive asset tracking;

- Support for traditional investments and cryptocurrencies;

- Financial planning advice;

- Secure document storage;

- User-friendly interface.

SigFig: An Affordable Robo-Advisor for Newer, More Traditional Investors

SigFig positions itself as an affordable robo-advisor designed to cater to newer and more traditional investors who seek a simplified approach to wealth management. With a focus on accessibility and ease of use, SigFig aims to provide a seamless investment experience for individuals at various stages of their financial journey.

About SigFig

SigFig’s core mission revolves around democratizing access to sophisticated investment strategies. The platform leverages advanced algorithms to offer personalized investment recommendations and portfolio management services. Additionally, SigFig provides users with intuitive tools for monitoring portfolio performance and optimizing their investment decisions.

Key Features of SigFig:

| Features | Description |

|---|---|

| Automated Portfolio | Tailored investment portfolios based on individual risk tolerance and goals |

| Performance Monitoring | Real-time tracking of portfolio performance and investment insights |

| Diversification Analysis | Evaluation of portfolio diversification and recommendations for improvement |

Personal Capital: A Financial Planning Tool That Shines in the White-Glove Department

Personal Capital distinguishes itself as a comprehensive financial planning tool that excels in providing personalized, high-touch advisory services. Targeting affluent individuals and those seeking a more hands-on approach to wealth management, Personal Capital offers a suite of features tailored to meet the needs of discerning investors.

About Personal Capital

The hallmark of Personal Capital lies in its ability to combine cutting-edge technology with human expertise, creating a hybrid model that delivers sophisticated financial planning and investment management services. The platform’s financial advisors work closely with clients to develop customized wealth management strategies, leveraging advanced analytical tools to optimize investment portfolios and maximize returns.

Notable Features of Personal Capital:

- Holistic Financial Planning;

- Dedicated Financial Advisors;

- Customized Investment Strategies;

- Access to Exclusive Events and Workshops;

- Advanced Analytical Tools.

A Clear Winner in the SigFig vs. Personal Capital vs. Kubera Battle

Each of these financial management tools offers distinct advantages suited to different investor profiles. Kubera excels in providing a comprehensive, all-encompassing solution for modern, diverse investors, offering a wide range of features to manage various asset classes. SigFig, on the other hand, targets newer and more traditional investors with its affordable robo-advisor services and user-friendly interface. Personal Capital stands out as a top choice for individuals seeking a white-glove approach to financial planning, combining advanced technology with personalized advisory services.

When choosing among SigFig, Personal Capital, and Kubera, it’s essential to consider your specific financial goals, investment preferences, and the level of support and guidance you require.

Conclusion

In conclusion, the landscape of digital financial management tools continues to evolve, offering individuals a diverse array of options to manage and grow their wealth effectively. SigFig, Personal Capital, and Kubera represent three leading platforms, each catering to distinct investor profiles with unique features and benefits. Whether you prioritize comprehensive asset tracking, affordability and simplicity, or personalized financial guidance, there is a wealth management tool tailored to meet your specific needs. By understanding the strengths and limitations of SigFig, Personal Capital, and Kubera, you can make an informed decision to propel your wealth-building journey forward with confidence and clarity.

+ There are no comments

Add yours