Cryptocurrency has transcended its origins as a niche interest pursued by acquaintances. In recent years, investors have been captivated by the meteoric rise in the value of Bitcoin, Ethereum, and other digital assets. Consider this: had you invested in Bitcoin back in April 2017, you could have witnessed a staggering 3,700% return on your investment. This surge propelled cryptocurrency investment into the mainstream, with major banks now actively involved in digital currency transactions. Furthermore, numerous prominent companies have embraced cryptocurrencies as a legitimate form of payment.

If you’ve yet to explore cryptocurrency investment, don’t fret; there’s still time. However, be aware that navigating this realm can be daunting. The plethora of digital currencies available can be overwhelming, and crypto markets are notoriously volatile, exposing investors to substantial risk. For newcomers, diligent research is essential. Continue reading for a comprehensive guide to cryptocurrency investment, including the best methods for monitoring the performance of your investments alongside the rest of your portfolio.

Cryptocurrency: Beyond Traditional Financial Systems

- Cryptocurrency represents a groundbreaking category of digital assets, existing solely in the virtual realm;

- These digital currencies serve dual purposes: they can be utilized both as investment vehicles and as a means for purchasing goods and services;

- Each cryptocurrency is unique, identified by a distinct code that safeguards against replication.

The revolutionary aspect of cryptocurrency lies in its decentralized nature, operating independently of traditional financial institutions such as banks and governments. This decentralization is facilitated by a technology called blockchain, a public ledger that transparently records and secures every transaction across a network of computers, without the need for a centralized authority. Blockchain’s innovation lies in its ability to offer an anonymous, yet secure, history of all transactions for any digital currency, accessible to anyone worldwide.

The cryptocurrency landscape is vast, with thousands of variants, each powered by its own blockchain technology. Bitcoin, the first and most renowned cryptocurrency, set a precedent in 2009, reaching an unprecedented valuation of over $63,000 earlier this year.

The Advantages of Cryptocurrency Investments

- Cryptocurrency has become a favored investment option due to its ease of access and potential for significant returns. Unlike traditional stock markets, the crypto market operates 24/7, offering low transaction fees and accessibility from anywhere at any time;

- Compared to fiat currencies, cryptocurrencies are perceived as a more stable store of value, immune to devaluation by central authorities. The elimination of intermediaries in transactions ensures ease of exchange and enhances security, contributing to its appeal. Advocates of cryptocurrency view it as the currency of the future, anticipating its increased acceptance and, consequently, its appreciation in value;

- The allure of investing in cryptocurrency primarily stems from its high volatility, which, while risky, offers the prospect of substantial profits. Savvy investors can capitalize on market fluctuations for significant gains. However, the unpredictable nature of crypto prices entails a high level of risk, making it imperative for investors to approach the market with caution and informed strategies.

Understanding the nuances of cryptocurrency investment is crucial for navigating its complexities safely and profitably.

Cryptocurrency Investments: Strategies for Smart Investors

Cryptocurrency represents an innovative asset class that can enrich a progressive investor’s portfolio. However, given its vast and volatile nature, diving into the crypto market requires a well-thought-out strategy to avoid potential pitfalls.

Here are essential strategies to guide you through investing in cryptocurrency wisely.

Strategically Allocate a Portion of Your Portfolio to Cryptocurrencies

Cryptocurrencies are speculative assets, with their values highly dependent on market demand. This inherent volatility means they may not always be a sound investment for everyone. It’s advisable to build a foundation of stable, traditional investments like stocks in growth-oriented mutual funds or real estate before venturing into cryptocurrencies. Ensure you’re financially secure, debt-free, and have an emergency fund covering several months’ expenses before allocating a modest percentage of your portfolio—typically no more than 5% as suggested by many experts—to cryptocurrencies.

Conduct Thorough Research Before Investing

The cryptocurrency market is saturated with thousands of digital currencies, each with unique features and potential. Before investing, it’s crucial to understand the specifics of the coin you’re interested in. Most cryptocurrencies provide whitepapers that detail their operation and value proposition. Access these documents through online databases to gain a comprehensive understanding. If a cryptocurrency’s profit generation mechanism is unclear, it may be wise to consider other options.

Diversify Your Cryptocurrency Investments

While Bitcoin might dominate the market and public discourse, limiting your investments to a single cryptocurrency increases your risk exposure to its volatility. A well-diversified portfolio, including a mix of cryptocurrencies with varying market caps, can mitigate these risks. Although the market is skewed towards the top five cryptocurrencies, which account for a significant portion of the market’s value, diversifying can cushion against market fluctuations and increase your chances of investing in a high-performing currency.

Balancing your cryptocurrency investments, much like managing a traditional portfolio, involves periodically rebalancing to maintain your desired allocation. For example, if one of your holdings significantly appreciates in value, exceeding your target allocation, consider realigning your portfolio by redistributing the gains across other investments. This strategy ensures you capitalize on gains while maintaining a balanced and risk-managed investment approach.

Establishing Risk Management in Cryptocurrency Investment

Investing in cryptocurrency can be highly volatile, making it imperative to have a solid risk management plan in place. The unpredictable nature of short-term price movements can easily lead to impulsive decision-making, potentially resulting in significant losses. To mitigate these risks, every crypto investor should establish clear guidelines for buying and selling.

These guidelines will vary based on individual preferences and investment goals. Long-term investors may choose to hold onto their assets regardless of price fluctuations, while short-term traders may opt to sell when a coin’s value drops by a certain percentage to limit losses.

Regardless of strategy, it’s crucial for new investors to adhere to predefined limits on the amount of money allocated to cryptocurrency investments. Starting with a small portion of one’s overall investment portfolio can help mitigate potential losses and provide flexibility in adjusting positions. Additionally, having an exit strategy in place before entering any trade can help prevent emotional decision-making and ensure a disciplined approach to investing.

Strategies and Tools for Effective Trading

Embarking on the journey of cryptocurrency trading can be exciting and rewarding, provided you’re equipped with the right strategies and tools. This guide aims to demystify the process, making it accessible for both newcomers and seasoned traders alike.

1. Selecting a Trading Platform: Exchange vs. Broker

To begin trading in the digital currency space, the first step is to choose a suitable platform. There are two primary options: cryptocurrency exchanges and brokers.

Exchanges serve as digital marketplaces for buying and selling cryptocurrencies. They usually offer competitive fees, though platforms with user-friendly interfaces may charge a bit more. For beginners, it’s crucial to find exchanges that are not only simple to navigate but also offer educational content and dependable customer support. Prominent exchanges include Binance and Coinbase, with others like Kraken, Gemini, and Bisq also being notable. Utilizing comparison tools can provide insights into the unique features of each exchange.

On the other hand, cryptocurrency brokers simplify the trading process by executing trades on your behalf. While they tend to have higher fees and may have restrictions on moving your crypto to external wallets, platforms like Robinhood and Sofi remain popular for their convenience.

2. Funding Your Account

Once you’ve chosen a platform, the next step is to deposit funds. Most platforms accept traditional fiat currencies and offer various methods for deposits, including debit card payments, wire transfers, and ACH transfers. Although some platforms allow credit card purchases of cryptocurrency, this is generally discouraged due to potential high interest rates and fees.

3. Executing Trades

With your account funded, you’re ready to buy and sell. While not every cryptocurrency will be available on all platforms, you’ll likely find a wide selection, including major ones. Investing in fractional shares of expensive coins is advisable to manage risk. Platforms also offer different types of orders—spot, margin, and futures trading—to suit various trading strategies.

4. Securing Your Cryptocurrency: Digital Wallets

Due to the online nature of cryptocurrency, securing your investments is critical. Digital wallets offer a solution, with “hot wallets” providing online storage and “cold wallets” offering offline storage for added security. While exchanges may offer wallet services, exploring independent hot wallet providers or investing in a cold wallet is worth considering for enhanced security.

5. Tracking Your Portfolio: Utilizing a Crypto Portfolio Tracker

For efficient management of your investments, a crypto portfolio tracker is invaluable. It allows for easy monitoring of investment performance and helps in making informed decisions. The ideal tracker would integrate seamlessly with your overall investment portfolio, offering a holistic view of your financial assets.

By following these steps and employing the recommended tools, navigating the cryptocurrency market can become a more structured and potentially rewarding endeavor.

Streamlining Asset Management

Managing investments, whether in cryptocurrencies or traditional assets, demands vigilance regardless of your experience level. Maintaining a diversified portfolio is crucial, but it can quickly become overwhelming without the right resources.

This challenge is particularly pronounced in the realm of cryptocurrency. With investments spread across various digital currencies, purchased from different exchanges, and stored in separate wallets, calculating the total value of your crypto holdings can be perplexing.

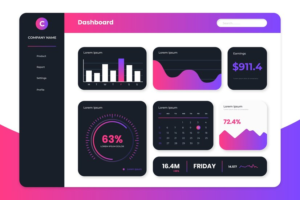

Enter the crypto portfolio tracker – a tool designed to streamline this process by consolidating all your digital assets into a single, easily accessible dashboard. With real-time updates on the performance of each coin and insights into their long-term trends, these trackers provide invaluable assistance to investors.

However, the landscape of portfolio trackers is far from homogeneous. While some platforms offer comprehensive solutions, many are fragmented. Traditional tools often lack support for cryptocurrencies, while crypto-specific trackers may not integrate seamlessly with fiat currencies, limiting their utility for investors seeking a holistic view of their assets.

Nevertheless, amidst this fragmentation, there are solutions that bridge the divide. These platforms offer unified tracking capabilities, enabling investors to monitor both crypto and traditional assets in a single interface. By embracing these versatile tools, investors can gain a comprehensive understanding of their entire investment portfolio, empowering them to make informed decisions and optimize their financial strategies.

Conclusion

While the world of cryptocurrency may seem daunting, armed with a comprehensive understanding of its unique properties and detailed insights on responsible investment, even late adopters can navigate this new territory. The key is to approach it with a balance of optimism and caution, understanding the risks, and making informed decisions. Welcome to the dynamic world of cryptocurrency investment!

Cryptocurrency investments, though complex and volatile, offer a distinct opportunity for profit. Understanding the core dynamics of digital currency and developing a strong investment strategy are essential steps toward minimizing risk and maximizing return. From comprehending the underlying technology to tracking your investments, every aspect of the process is crucial. With the guidelines provided in this article, you are well-equipped to venture into the exciting world of crypto investment. Balancing knowledge, strategy, and caution, you too can tap into the potential of the cryptocurrency market.

+ There are no comments

Add yours