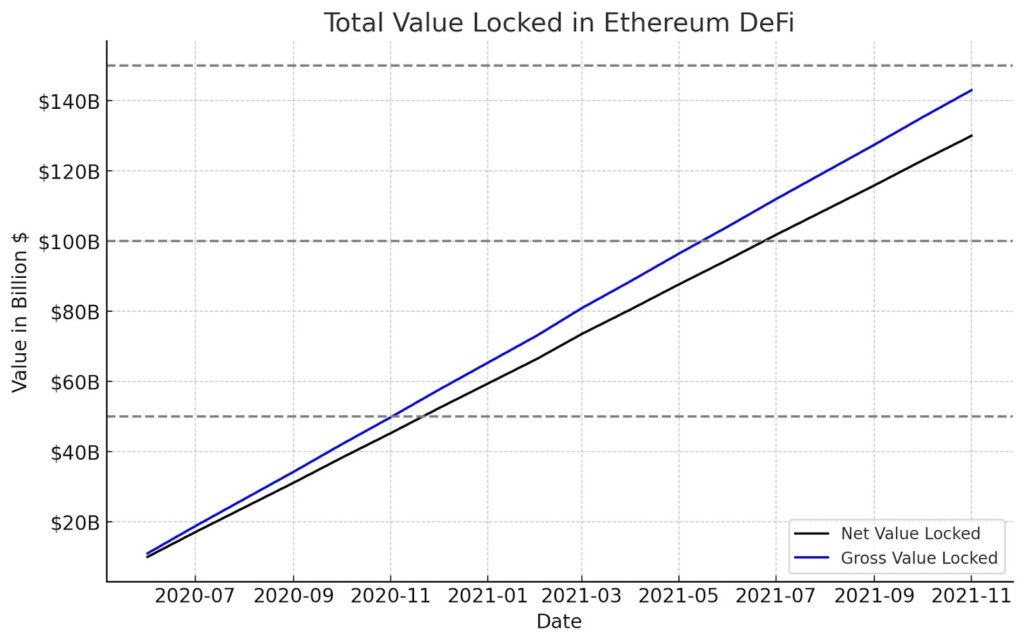

The world of decentralized finance (DeFi) is expanding at an unprecedented pace, offering a plethora of opportunities and risks for investors. As of November 2023, the total value locked (TVL) in DeFi surged to a staggering $120 billion, marking a remarkable 1,200% increase since June 2020.

This exponential growth underscores the potential of DeFi to revolutionize and democratize the traditional banking industry. Whether you are a seasoned investor or new to the space, the soaring potential of DeFi cannot be overlooked, promising substantial returns. However, with these prospects come inherent risks. Often referred to as the “Wild West” of finance, DeFi remains largely unregulated and susceptible to security vulnerabilities, necessitating caution and informed investment decisions. In this dynamic landscape, leveraging the right tools becomes crucial. These tools streamline the investment process within the intricate DeFi ecosystem, offering essential support to optimize exposure and mitigate risks. This article delves into the fundamental aspects of DeFi, elucidates its operational mechanisms, and presents six indispensable DeFi tools designed to empower investors in making informed decisions and maximizing their investments.

What is DeFi?

First things first, let’s revisit the concept of DeFi. Short for decentralized finance, DeFi encompasses a digital framework of financial products and services accessible to the public through computer programs, commonly known as protocols, that leverage blockchain technology. This innovative approach aims to eliminate intermediaries, providing a transparent, open, and inclusive financial system.

How Does DeFi Work?

DeFi operates on the principles of blockchain technology, utilizing smart contracts to automate and execute financial transactions without the need for traditional intermediaries such as banks or brokerage firms. By leveraging decentralized applications (dapps) and protocols, users can engage in various financial activities, including lending, borrowing, trading, and yield farming, while retaining control over their assets and transactions.

Kubera

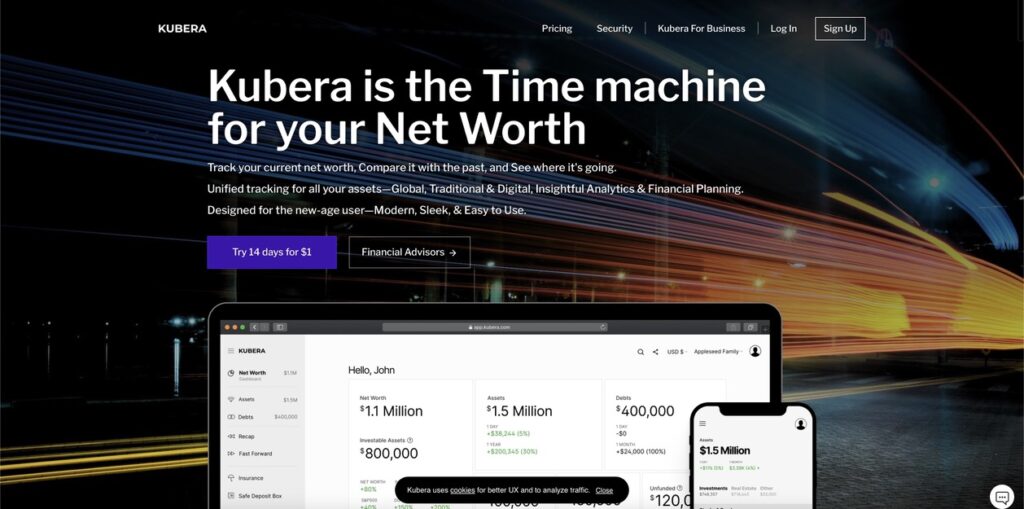

Kubera stands out as an all-encompassing portfolio tracker that offers comprehensive insights and analytics for managing DeFi investments. This tool provides real-time tracking of diverse assets across multiple platforms, enabling investors to monitor their holdings, track performance, and assess portfolio diversification. With intuitive visualizations and customizable reporting features, Kubera empowers users to make informed decisions and optimize their investment strategies.

Sample Portfolio Overview on Kubera

| Asset | Quantity | Value (USD) | Allocation (%) |

|---|---|---|---|

| Bitcoin (BTC) | 2.5 | $125,000 | 30 |

| Ethereum (ETH) | 10 | $40,000 | 20 |

| Aave (AAVE) | 500 | $75,000 | 25 |

| Uniswap (UNI) | 1000 | $50,000 | 15 |

| Total | $290,000 | 100 |

MetaMask

MetaMask emerges as a leading DeFi wallet, offering a secure and user-friendly interface for managing digital assets and interacting with decentralized applications. As a browser extension and mobile application, MetaMask enables seamless access to DeFi protocols, facilitating asset storage, transfers, and interactions with dapps. Its integration with various blockchains and support for non-fungible tokens (NFTs) further enhances its utility, making it an indispensable tool for DeFi enthusiasts.

Key Features of MetaMask

- Secure storage of cryptocurrencies and tokens;

- Seamless interaction with decentralized applications;

- Multi-chain support, including Ethereum, Binance Smart Chain, and more;

- Integration with hardware wallets for enhanced security.

DeFi Llama

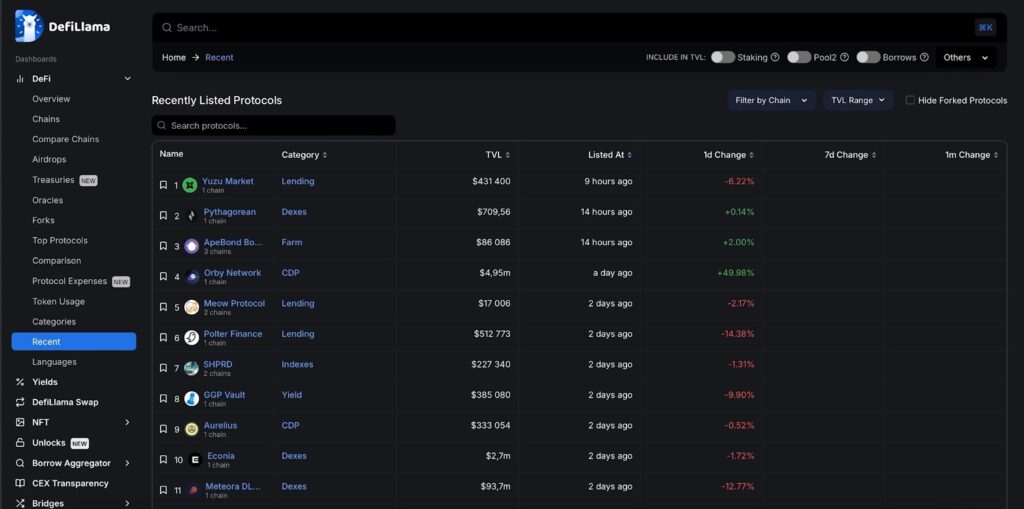

DeFi Llama serves as a powerful analytics platform, offering advanced metrics and insights into the performance of DeFi protocols and liquidity pools. With comprehensive data visualization and comparative analysis, DeFi Llama empowers investors to evaluate protocol health, monitor yield farming opportunities, and identify emerging trends within the DeFi ecosystem. Its user-friendly interface and customizable dashboard make it an invaluable resource for informed decision-making.

Comparative Analysis of DeFi Protocols on DeFi Llama

| Protocol | TVL (USD) | APR (%) | Users |

|---|---|---|---|

| Aave | $5.2 billion | 7.8 | 320,000 |

| Compound | $3.6 billion | 6.5 | 280,000 |

| Uniswap | $4.1 billion | 8.2 | 420,000 |

| SushiSwap | $2.9 billion | 9.5 | 250,000 |

DeFi Pulse

DeFi Pulse serves as a premier platform for tracking and monitoring the performance of various DeFi protocols, offering a comprehensive leaderboard that ranks protocols based on their total value locked (TVL). This invaluable resource provides real-time data on protocol rankings, historical trends, and TVL distribution across different networks, enabling investors to gauge the market dynamics and identify prominent players within the DeFi space.

Key Insights from DeFi Pulse

- Real-time ranking of DeFi protocols by TVL;

- Historical data and trend analysis;

- TVL distribution across different blockchains;

- Protocol-specific details and performance metrics.

Dune Analytics

Dune Analytics stands out as a versatile platform for conducting in-depth blockchain research and analysis within the DeFi landscape. By offering customizable queries and interactive dashboards, Dune Analytics empowers users to explore on-chain data, track transaction volumes, and gain insights into protocol activities. This tool proves instrumental in uncovering market trends, assessing user behavior, and identifying potential investment opportunities within the DeFi sector.

Transaction Volume Analysis on Dune Analytics

| Protocol | Total Transactions | Average Gas Fee (Gwei) | Unique Addresses |

|---|---|---|---|

| Uniswap | 2.1 million | 45 | 320,000 |

| SushiSwap | 1.8 million | 50 | 280,000 |

| Curve Finance | 1.5 million | 55 | 240,000 |

| Balancer | 1.2 million | 60 | 200,000 |

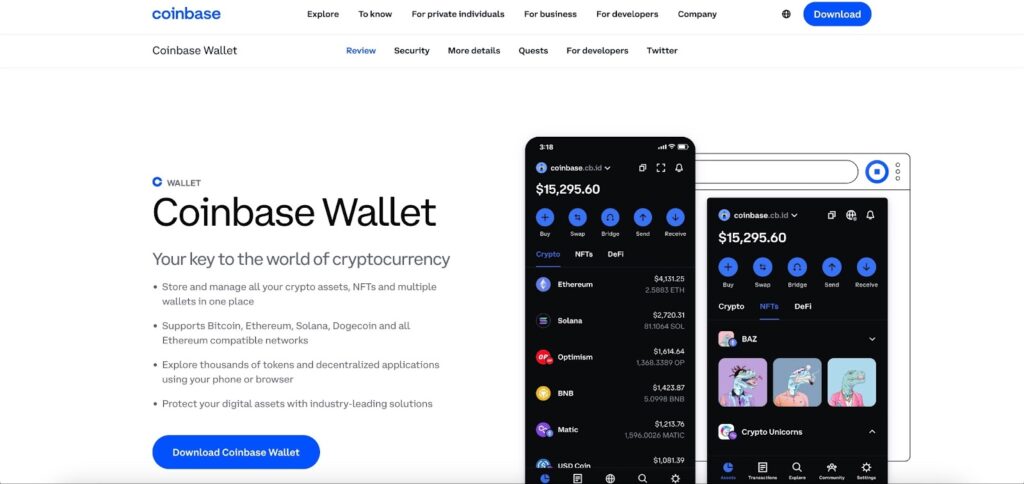

Coinbase Wallet

Coinbase Wallet offers a user-friendly and secure solution for accessing DeFi applications and managing digital assets. With its intuitive interface and seamless integration with the Coinbase exchange, this wallet simplifies the process of interacting with DeFi protocols, enabling users to buy, sell, and store cryptocurrencies with ease. Its robust security features and compatibility with a wide range of tokens make it an ideal choice for both novice and experienced DeFi investors.

Conclusion

In conclusion, the rapid evolution of the decentralized financial landscape presents unparalleled opportunities for investors seeking to capitalize on the burgeoning ecosystem. However, navigating this dynamic terrain requires a strategic approach and the utilization of essential tools tailored to the unique demands of investing in decentralized finance. By leveraging platforms such as Kubera, MetaMask, Llama, Pulse, Dune Analytics, and Coinbase Wallet, investors can gain valuable insights, manage their portfolios effectively, and stay abreast of market trends. These tools not only streamline the investment process but also empower investors to make informed decisions, ultimately maximizing their potential within this space. As the sector continues to mature, the role of these tools in shaping the future cannot be overstated, underscoring their significance in driving innovation and fostering a more inclusive financial landscape.

+ There are no comments

Add yours